The insurance industry is evolving rapidly. Traditional paper-based processes and slow claims handling are giving way to digital policies, artificial intelligence (AI), and automation. These changes are transforming how customers buy insurance, manage policies, and file claims, making the experience faster, more efficient, and more personalized.

This article explores the future of insurance and how technology is reshaping the industry.

Digital Policies: Convenience at Your Fingertips

What Are Digital Policies?

Digital insurance policies are fully electronic, allowing customers to purchase, store, and manage coverage online. Instead of dealing with paperwork and physical documents, everything—from quotes to renewals—is handled through apps or websites.

Benefits of Digital Policies

- Easy Access: View your coverage anytime from your phone or computer.

- Faster Processing: Immediate policy issuance without waiting for physical mail.

- Environmentally Friendly: Reduces paper use and physical storage.

- Customizable Coverage: Digital platforms often offer tools to adjust coverage instantly.

Digital policies simplify interactions, especially for tech-savvy customers who expect quick, user-friendly experiences.

AI in Claims Processing

Artificial intelligence is changing the way insurance claims are handled. From detecting fraud to speeding up approvals, AI makes the claims process more efficient and accurate.

How AI Improves Claims

- Automated Claim Assessment: AI algorithms can evaluate damage from photos, estimate repair costs, and determine claim eligibility quickly.

- Fraud Detection: AI analyzes patterns and flags suspicious claims, protecting insurers and honest policyholders.

- Faster Payouts: Automated systems reduce delays, allowing customers to receive funds sooner.

- Personalized Support: AI chatbots provide 24/7 assistance, answering questions and guiding customers through the process.

Example in Action

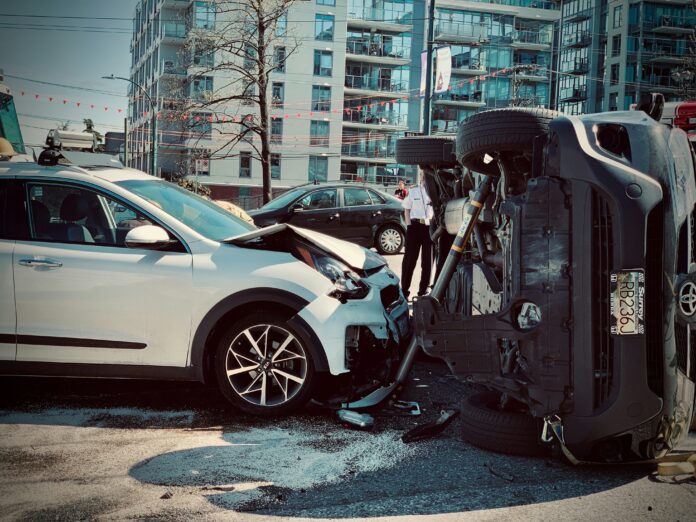

Imagine a car accident:

- You take a photo of the damage and submit it through an app.

- AI evaluates the damage and calculates an estimate.

- Within hours, the insurer approves the claim, and funds are sent for repairs.

This eliminates weeks of paperwork and phone calls.

Other Technology Trends in Insurance

Telematics and Wearables

- Devices like fitness trackers and vehicle telematics help insurers understand behavior and risk.

- Customers can receive personalized premiums based on safe driving or healthy lifestyle habits.

Blockchain

- Blockchain technology ensures secure, transparent, and tamper-proof records of policies and claims.

- It can simplify claims verification and reduce administrative errors.

On-Demand Insurance

- Digital platforms allow users to purchase coverage only when needed—for example, insuring a rental car or vacation property temporarily.

- This flexibility appeals to younger customers and gig economy workers.

Benefits of Technology for Customers

- Faster, more accurate claims

- More control over policies and coverage

- Personalized pricing based on individual risk profiles

- Reduced administrative hassle and paperwork

Challenges and Considerations

While technology brings efficiency, it also introduces challenges:

- Privacy and Security: Storing sensitive data digitally requires strong cybersecurity measures.

- Reliance on AI: Automated decisions must be carefully monitored to avoid errors or bias.

- Digital Divide: Older customers or those without tech access may find digital processes challenging.

Final Thoughts

The future of insurance is digital, automated, and AI-driven. Digital policies, AI claims processing, telematics, and blockchain are transforming how coverage is purchased, managed, and utilized.

For consumers, these innovations mean faster service, personalized premiums, and easier access. For insurers, technology allows cost savings, fraud prevention, and more accurate risk assessment.

Adapting to this digital future ensures both customers and companies can enjoy a more efficient, secure, and responsive insurance experience.